2024 Average Euro Rate: A Data-Driven Outlook

Predicting the average Euro to Turkish Lira (EUR/TRY) exchange rate for 2024 is inherently complex, akin to forecasting long-term weather patterns. Numerous interconnected factors influence currency valuation, and past performance, while informative, is not a reliable predictor of future trends. This analysis will examine known and unknown variables, offering a data-driven assessment of potential outcomes. Will the volatility of recent years continue? What macroeconomic indicators suggest a potential stabilization? These are the questions we will address.

The Turkish Lira's Volatility: A Historical Perspective

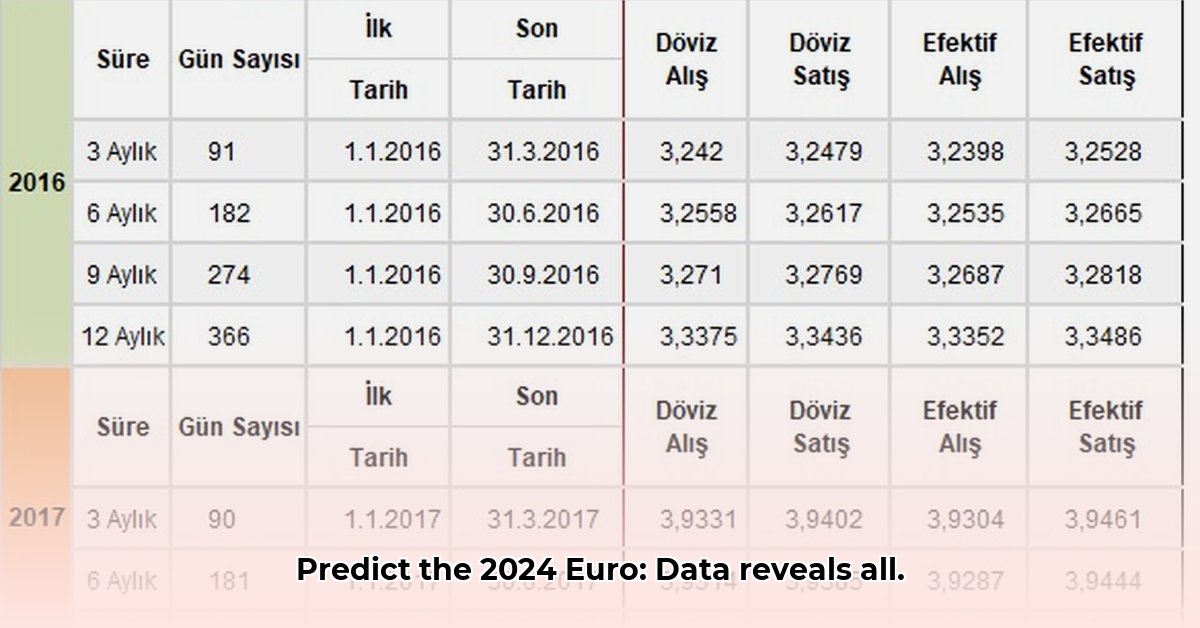

The EUR/TRY exchange rate has demonstrated significant volatility since 1998. Periods of relative stability have been punctuated by dramatic fluctuations. Understanding these shifts requires a multifaceted analysis, considering inflation, domestic and international political events, and global economic conditions. However, a significant challenge lies in the inconsistencies across different data sources. Daily and monthly averages vary, even within official Turkish Central Bank reports, making direct comparisons problematic. Rigorous source verification and methodological awareness are crucial for accurate analysis.

Key Factors Shaping the 2024 Euro Rate

Several crucial factors will significantly influence the average EUR/TRY exchange rate in 2024:

Inflation: Turkey's inflation rate remains a dominant factor. High inflation erodes the Lira's purchasing power, weakening its value against the Euro. Controlling inflation will be paramount in stabilizing the currency.

Interest Rates: The Central Bank of Turkey's monetary policy, specifically interest rate adjustments, directly impacts investor confidence and capital flows. Higher rates can attract foreign investment, strengthening the Lira, while lower rates can have the opposite effect.

Geopolitical Landscape: Political stability (or instability) within Turkey and its international relations play a crucial role. Geopolitical uncertainties often trigger capital flight, negatively impacting the Lira.

Global Economic Conditions: A global recession or a major unforeseen event (e.g., a significant energy crisis) can trigger ripple effects across international markets, including the EUR/TRY exchange rate.

Predicting the Future: Challenges and Potential Risks

Predicting the average EUR/TRY exchange rate for 2024, even with sophisticated models, is inherently uncertain. Unforeseen events, by their nature, are unpredictable and can significantly alter market dynamics. The table below outlines some potential risks and mitigation strategies. How can these be mitigated? What measures can be taken to ensure stability?

| Potential Problem | Likelihood | Impact | Mitigation Strategies |

|---|---|---|---|

| High and persistent inflation | High | Very High | Implementation of robust anti-inflationary measures by the Turkish government. |

| Political instability | Moderate | High | Promotion of political stability and international cooperation. |

| Global economic slowdown | Moderate | High | Economic diversification and reduction of dependence on global trade. |

| Sudden capital flight | Moderate | Very High | Attracting foreign direct investment and strengthening currency reserves. |

| Data inconsistencies | Low | Moderate | Triangulation of data from multiple reliable sources and careful methodology comparison. |

Stakeholders Impacted by EUR/TRY Fluctuations

Numerous entities are directly affected by the EUR/TRY exchange rate:

International Investors: Require careful monitoring of macroeconomic indicators and may employ hedging strategies to mitigate currency risk.

Turkish Exporters: May benefit from locking in Euro-denominated contracts to protect profit margins against Lira depreciation.

Turkish Importers: Face increased costs with a weaker Lira, necessitating strategies to manage import expenses.

Turkish Government: Responsible for implementing sound economic policies to promote stability and curb inflation.

Central Bank of Turkey: Plays a crucial role in managing monetary policy and maintaining currency stability. What measures will they consider to ensure stability?

Data Accuracy and Comparison: Navigating Methodological Challenges

Analyzing historical EUR/TRY exchange rate data demands meticulous attention to data consistency. Disparities among sources often stem from varying data collection frequencies, averaging methods, and reporting time zones.

Key Considerations:

- Prioritize reputable sources like international financial institutions and central banks.

- Carefully examine each source's data specifications (frequency, time zone, averaging method).

- Employ visual comparisons (graphs) to identify discrepancies.

- Perform statistical analysis (mean, median, standard deviation) across datasets.

- Attempt to reconcile any discrepancies, understanding the reasons for variations.

- Consider a weighted average for a consolidated figure, prioritizing reliable sources.

This analysis offers a framework for understanding the complexities of predicting the average EUR/TRY exchange rate for 2024. While precise prediction remains inherently challenging, recognizing the key influencing factors and potential risks is crucial for informed decision-making by all relevant stakeholders. Continuous monitoring of economic news and expert opinions is essential for navigating this dynamic environment.